Mint.com

Price: FREE

Version Reviewed: 1.0.1

iPhone Integration [rating:4/5]

User Interface [rating:3.5/5]

Re-use / Replay Value [rating:3.5/5]

Overall Rating:

When I moved from an iPod Touch to an iPhone last summer, mobile banking promised to become much more robust. My bank, Bank of America, was one of the first to release an iPhone app. I happily downloaded the app in anticipation of having a much more up-to-date handle on my finances and was instantly thwarted. I had chosen to protect my account with fairly robust passwords that took a lot of time to enter on an iPhone, and my bank refused to save my login (probably for security and privacy reasons). So the prospect was abandoned and I returned using their phone service for mobile banking.

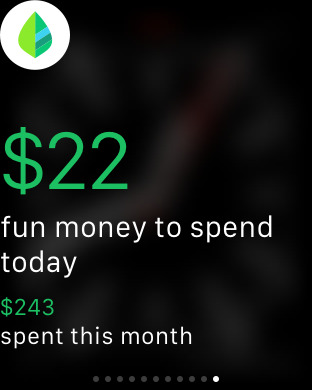

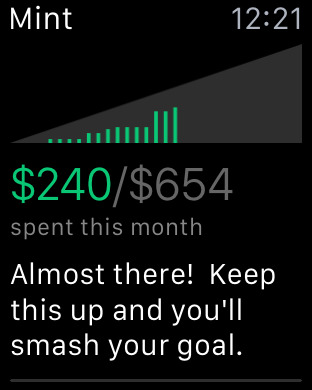

I stumbled across Mint.com about a month ago, setup my accounts and downloaded the iPhone application. There are features that I'd love to see added, but overall Mint can give you easy access to all of your accounts and transactions.

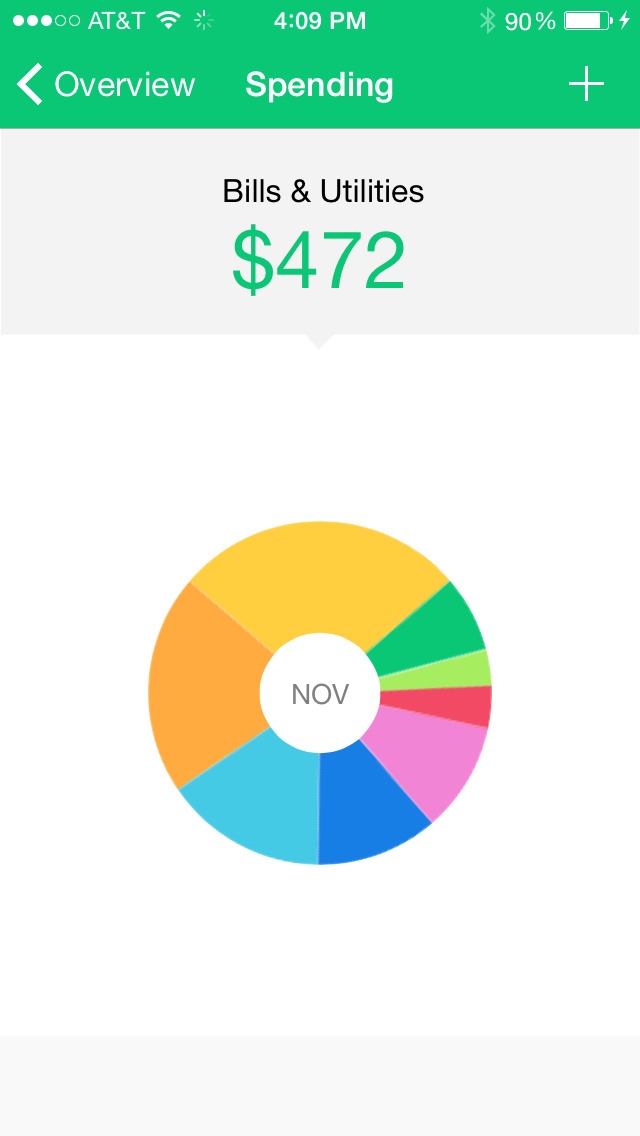

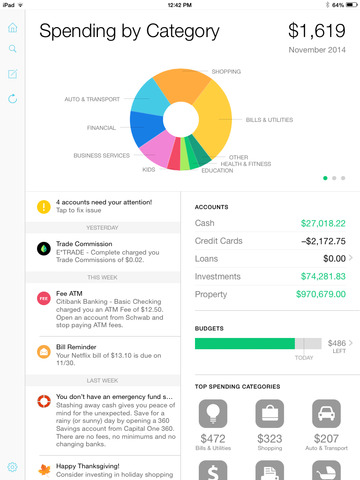

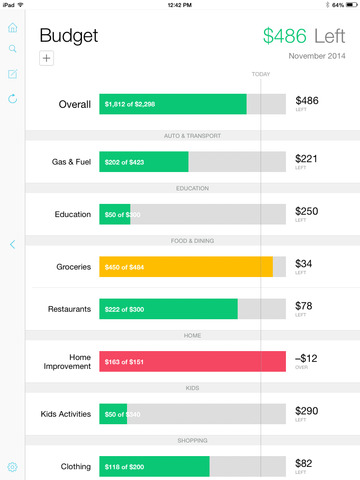

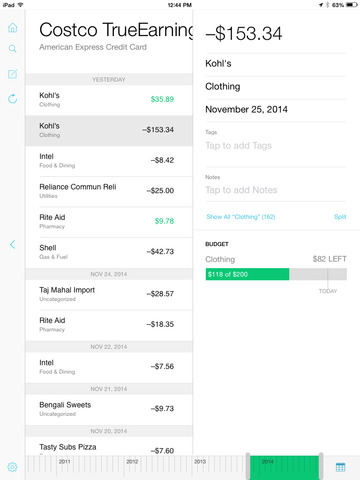

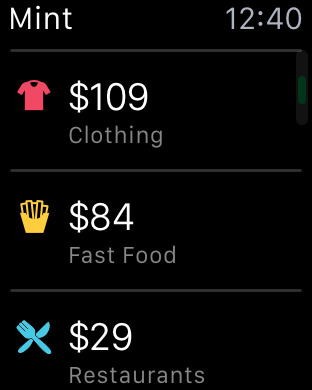

For example, Wet Seal is, at least in my region, women's clothing retailer not a Sporting Goods store. A visit to the site will allow you to correct these sort of errors. The Cash Flow section sorts transactions by basic categories a lot like the Budget section, but also sorts by merchant name. So if you're spending far too little in the App Store, you can put yourself back on track. The Investments section shows the performance of your accounts over time. I do not currently have investments that work with their system. Anywhere in the application you may also access the Alerts tab. Alerts provide customizable notification of anything from bank fees or credit balance to unusual spending and credit card due dates. You may delete these notifications at any time. This is the only place where a user may edit something in the application.

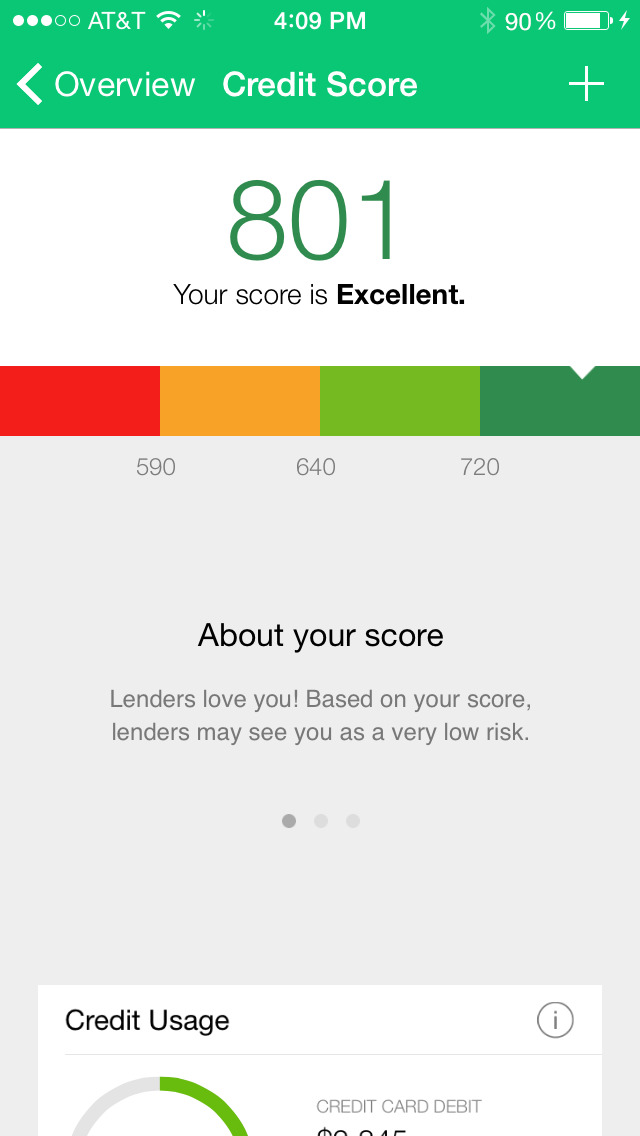

The beautiful part of this application is its integration. If your accounts are supported, you will be granted a lot of data about where your money is going or what you're earning. The interface is simple and well sorted. With identity theft and phishing as major concerns, it is increasingly important to monitor accounts for strange transactions. Mint's application makes it very easy to do so.

All of these features come with the inherent limitations of the site. While Mint.com advertises over 7,500 partners, there's still a good chance that your particular bank, credit cards or investment broker won't play nicely with Mint. For example, I tried to set my mother up with a Mint account but her credit union was not supported. A lot of people who prefer small banks or credit unions will probably run into the same situation. The blame for this limitation can't really be placed on either Mint or small, local banks who may not have the resources to provide safe access through the portal. At times, even if your bank is supported, the data may update slowly or may not include the most recent pending transactions. So, while Mint is great for an overview, you will have to balance your checking account for a little while into the future.

If you can use the application with your accounts, there is the consideration of privacy. While what Mint.com does with your financial data is too large a discussion for this review, how it protects the data on your phone is worth considering. Mint offers no application-based passcode or password lock. They instead suggest enabling the iPhone's passcode lock with short lock times. While this is good advice (that I follow), it would be nice to have a secondary layer of security. I might want to show my iPhone to a friend or business associate. However, I might not want them to know that I have spent over one hundred dollars in the last two weeks at the local Starbucks or at the little Boba joint down the street. I might not even want them to know how much my 401k is losing earning. I suppose that another solution would be to log out of the app before closing it, but that would encourage me to make my Mint password less robust and that would send me back to the Bank of America app. Mint takes a great step in this direction by allowing you to de-authorize your iPhone remotely in case of theft.

In addition, the application at this time only really allows one to view their data and delete notifications. While that is all that is really necessary for credit, investments and budgets, it falls short when used with a checking account. Adding transactions that could be reconciled later would propel this program to the realm of a must-have application for basic finance tracking. Such an update would make instant balance updates, available balance and pending transactions a lower priority. Simple charts and graphs would also be greatly appreciated for people with investments.

Mint.com is a free application. If you're open to joining the site, it provides mobile financial data that is certainly worth the time it takes to setup. I hope that Mint will offer passcode protection in the future and that they'll expand their base of partners. Beyond those two caveats it can only get better with updates. The foundation of the application shows a lot of promise and I look forward to seeing what it does in the future.