App Description

CMA Part 1: Financial Reporting, Planning, Performance and Control

The percentages show the relative weight range given to each section in the exam.

A. External Financial Reporting Decisions 15%

Preparation of financial statements: balance sheet, income statement, statement of changes in equity, statement of cash flows; valuation of assets and liabilities; operating and capital leases; impact of equity transactions; revenue recognition; income measurement; major differences between U.S. GAAP and IFRS.

Topics Tested:

– Financial Statements

– Recognition, Measurement, Valuation and Disclosure

B. Planning, Budgeting and Forecasting – 30%

Planning process; budgeting concepts; annual profit plans and supporting schedules; types of budgets, including activity-based budgeting, project budgeting, flexible budgeting; top-level planning and analysis; and forecasting, including quantitative methods such regression analysis and learning curves.

Topics Tested:

– Strategic Planning

– Budgeting Concepts

– Forecasting Techniques

– Budgeting Methodologies

– Annual Profit Plan and Supporting Schedules

– Top-Level Planning and Analysis

C. Performance Management – 20%

Factors to be analyzed for control and performance evaluation including revenues, costs, profits, and investment in assets; variance analysis based on flexible budgets and standard costs; responsibility accounting for revenue, cost, contribution and profit centers; and balanced scorecard.

Topics Tested:

– Cost and Variance Measures

– Responsibility Centers & Reporting Segments

– Performance Measures

D. Cost Management – 20%

Cost concepts, flows and terminology; alternative cost objectives; cost measurement concepts; cost accumulation systems including job order costing, process costing, and activity-based costing; overhead cost allocation; operational efficiency and business process performance topics such as JIT, MRP, theory of constraints, value chain analysis, benchmarking, ABM, and continuous improvement.

Topics Tested:

– Measurement Concepts

– Costing Systems

– Overhead Costs

– Supply Chain Management

– Business Process Improvement

E. Internal Controls – 15%

Risk assessment; internal control environment, procedures, and standards; responsibility and authority for internal auditing; types of audits; and assessing the adequacy of the accounting information system controls.

Topics Tested:

– Governance, Risk and Compliance

– Internal Auditing

– Systems Controls and Security Measures

App Features:

• 2018 Latest Update

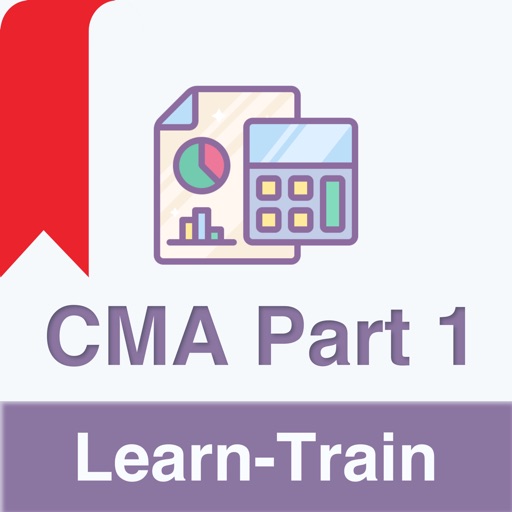

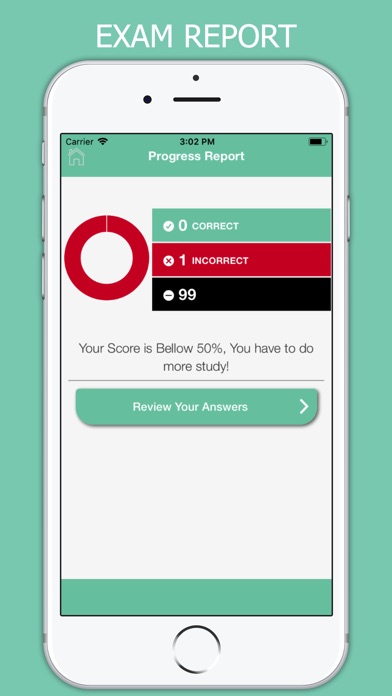

• Two Exam Modes: Virtual Mode, and Study Mode

• Quick Knowledge Mode

• Review Your Answers

• Well Researched Questions

• Auto Save Exam

• Progress Log

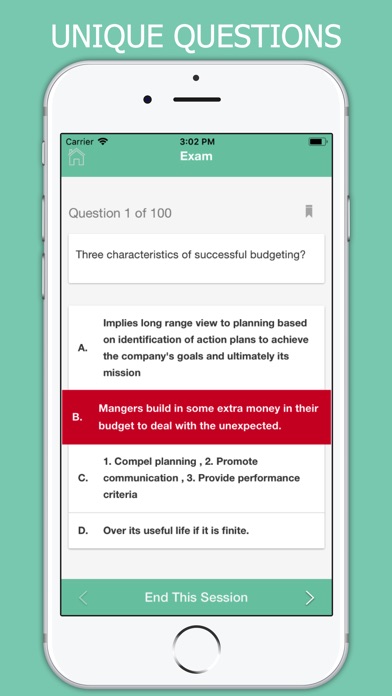

• Smart Filters

• Create Custom Exams

• Bookmark Questions

• Based on 2018 Syllabus

• Unique Questions

• No Additional Purchases or Subscriptions

• No Internet Connection is required

• Free Feature Updates

• Highest Passing Rate!

DISCLAIMER:

---

Learn & Train is Not Affiliated With Respected Testing Agency, Test/Exam Name or Any Trademark.

App Changes

- December 03, 2017 Initial release