Debt Down Review

Price: $0.99

Version Reviewed: 1.0.2

App Reviewed on: iPhone 5

iPhone Integration Rating:

User Interface Rating:

Re-use Value Rating:

Overall Rating:

Once bills start stacking up, it’s easy to keep accumulating debt. Instead of stressing about it, use Debt Down to start budgeting and paying it off to enjoy a debt-free lifestyle.

To get started, users will need to input all of their debts into the app. Simply tap Add Debt, enter the name of the bill, and select an icon to represent it. Then enter the basic information about it like the current balance, annual interest rate, and monthly payment. Tap Done to save the debt. Once all debts are entered, tap on Finish Editing to work on a payoff strategy.

Now it’s time to focus on paying off all that debt. Having a visual representation can help make it a little less stressful. One way Debt Down helps users is that it utilizes a debt-snowball method that can be turned on in the More section. This focuses on one debt at a time. Users pay as much as they can toward the creditor and continue to make minimum payments to other creditors. With this option, users can enter an extra payment they are willing to pay in addition to monthly debt payments. Users can then select a payoff strategy that they prefer.

One great aspect about Debt Down is that it provides payment due date notifications. Upcoming payments are displayed on the goal form. Simply tap the needed payment and tap Pay to confirm. Payment amounts can be adjusted at any time.

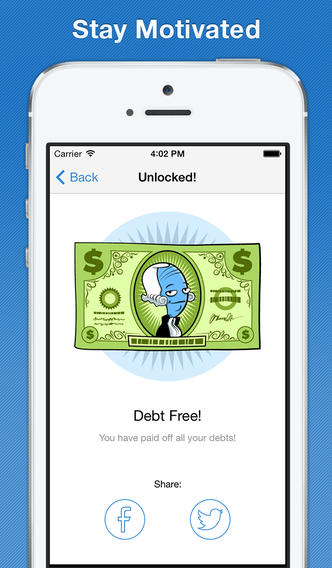

By analyzing the reports that Debt Down generates, users will be able to take control of their debt. There are several detailed reports that can be exported in PDF if desired. Other impressive features include a loan calculator, data backup, achievements, and passwords to protect data.

Debt Down does an excellent job providing users with a simple way to pay off debt. While it would be nice to be able to capture receipts and store them within the app, it’s certainly not a deal-breaker. For less than one dollar, iOS users get a lot of bang for their buck with Debt Down. Additionally, its easy to navigate user interface makes paying off debt a lot less stressful and much more manageable.